powertechexposed.com

Information about Azarga Uranium Corp., Powertech (USA) Inc., and proposed uranium mining in northern Colorado and South Dakota

CENTENNIAL PROJECT - COLORADO

Documents ● Maps ● News stories ● Articles & postings ● Lawsuit against Colorado ● Resolutions of opposition ● Proposed Section 33 pump test ● NI 43-101 Preliminary Assessment ● Photos ● Editorials & letters ● House Bill 08-1161 ● DRMS Hardrock Rulemaking ● Mine proximity ● Quotes ● CARD ● nunnglow.com ● townofnunn.net ● Colorado Dept. of Public Health and Environment ● Wikipedia ● Photos

"SLAC Scientists Search for New Ways to Deal with U.S. Uranium Ore Processing Legacy; New Field Project Tests Link Between Organic Materials and Persistent Uranium Contamination" - U.S. Department of Energy - January 22, 2015 (PDF 45 KB, 2 pages) From the article: "Researchers at the Department of Energy’s SLAC National Accelerator Laboratory are trying to find out why uranium persists in groundwater at former uranium ore processing sites despite remediation of contaminated surface materials two decades ago. They think buried organic material may be at fault, storing toxic uranium at levels that continue to pose risks to human health and the environment, and hope their study will pave the way for better long-term site management and protection of the public and environment."

|

POWERTECH/AZARGA REALITY CHECK |

|---|

| Random observations on Azarga Uranium Corp. (formerly Powertech Uranium Corp.) |

|

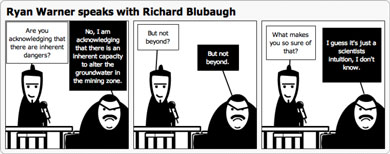

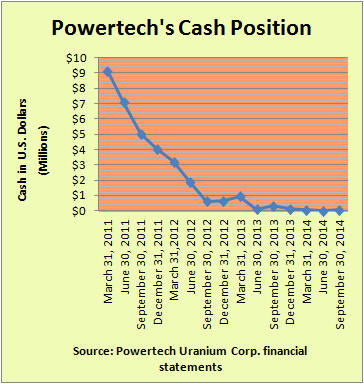

December 22, 2014 - On Friday, the Oglala Sioux Tribe, Powertech, and NRC staff filed briefs with the ASLB on whether Dewey-Burdock borehole logs and other drilling information should be publicly disclosed by Powertech. The Tribe has consistently argued in favor of disclosure, asserting the data are relevant to the question of whether Powertech can adequately contain toxic and radioactive mining fluids while conducting in-situ uranium leaching in ground water aquifers. Powertech argues the data should be kept secret because the project would be overseen by the Nuclear Regulatory Commission and the Environmental Protection Agency, and members of the public should simply trust these regulatory agencies to protect public health, safety, and the environment. But elsewhere in the brief Powertech discusses what may be the real reason, and tips its hand about the project's future. Powertech claims the logs were costly to obtain, they would have significant financial value to "any company attempting to develop the Dewey-Burdock ISR Project", and that releasing them "would de-value such data in the event of a future corporate transaction between Powertech and another corporate entity." Translation: Powertech/Azarga is contemplating selling the Dewey-Burdock project. It is unknown when the ASLB, short one member with the recent death of Richard Cole, will rule on the data confidentiality issue. December 18, 2014 - According to someone with knowledge of the matter, one of the three judges on the NRC's Atomic Safety and Licensing Board recently died. The judge, Richard F. Cole, PhD, is a sanitary engineer who has been a member of the NRC's ASLB panel since 1973. The ASLB is conducting the adjudicatory hearing on the source material license issued to Powertech for the proposed Dewey-Burdock in-situ leach uranium project. ASLB judges are employees of the NRC but are independent from NRC staff and the NRC's five-member Commission. Based on hearing transcripts, Cole appeared to be more sympathetic to Powertech than the other two judges, Chairman William Froehlich and Dr. Mark Barnett. It is unclear what effect Cole's passing will have on the continuing hearing process and its final outcome. If the current hearing schedule holds, the ASLB will issue its initial decision on the seven contentions raised by the Oglala Sioux Tribe and the Consolidated Intervenors by the end of April. Following the ruling, the parties have forty days to file petitions requesting review by the Commission. Opposing parties have an unspecified period of time to file answers to any petitions. If the Commission agrees to review the ASLB's decision, it will take several months to review the record and render a final decision. In a recent appeal to the Commission filed by a mining company seeking to expand the Crow Butte in-situ leach uranium mine in Nebraska, the Commission took eight months to issue its decision. Any Commission decision can be appealed in federal court. December 8, 2014 - Azarga Uranium chairman Alex Molyneux recently enlisted mining investment website operator Tommy Humphreys to write a glowing article about Azarga, complete with three slides from Azarga's recent investor presentation. The article is a blatant attempt to generate investor interest in Azarga's stock, which has been languishing near its 52-week low in spite of the completion of the reverse takeover of Powertech by Azarga Resources. Molyneux spins a yarn about how he was able to identify "the best projects on the planet...and buy them" during the uranium downturn "when no one was looking". A more complete assessment of the projects might include an observation that, after looking, few others were interested. The uranium assets assembled by Powertech are a mixed bag. While Powertech has spent $36 million since 2006 on the Dewey-Burdock project in the Black Hills of South Dakota, it has been unable to fully permit the project. An NRC license has been obtained, but a lengthy administrative hearing process is still underway that threatens the license. Multiple permits required by the EPA, BLM, and State of South Dakota have not been issued. And a large movement opposed to the project is poised to launch legal challenges to the license and permits. Powertech's defunct Centennial project in northern Colorado was a disaster for the company, triggering an unprecedented tightening of state uranium mining regulations, and culminating in an impairment writedown of 83% of the project's $15 million asset value. Powertech has spent relatively little on its various Wyoming properties, calling into question their value, given that Wyoming is arguably the most favorable uranium mining jurisdiction in the United States. The projects that Azarga Resources brought to the table are less than impressive. The Kyzyl Ompul project in Kyrgyzstan consists entirely of an 80% ownership stake in a Kyrgyz company whose only asset is a single exploration license that expires on December 31, 2015. Renewal of the license requires a minimum work program of drilling and sampling in 2015, but there is no mention of this work program in Azarga's November 12 Management Discussion and Analysis. According to an April technical report, the project area has a history of political unrest and "access to the property may be limited due to the roads being blocked by the local population". Azarga holds a 19% interest in Australian penny stock firm Black Range Minerals, currently valued at $1.3 million AUD. For years, Black Range has been promoting its Hansen/Taylor Ranch uranium project in southern Colorado, but it has yet to submit a mining permit application. The company is also a 50% partner in a joint venture attempting to commercialize ablation, a new uranium concentration technology. So far, the joint venture has been unable to demonstrate commercial viability and has not resolved regulatory questions with the Nuclear Regulatory Commission. Azarga owns 11% of another Australian penny stock firm, Anatolia Energy, a stake valued at $2.5 million AUD. Anatolia has two exploration projects, and has not announced when it expects to begin development of its first uranium mine. November 20, 2014 - Digging into Azarga's recently-issued third quarter Management Discussion and Analysis, the omissions and spin in the section on the proposed Dewey-Burdock project are striking. Chairman Alexander Molyneux has made Dewey-Burdock the centerpiece of his efforts to boost Azarga's share price, but the MD&A is lacking when it comes to helping investors understand the true status of the controversial project. A statement is made that construction may begin as early as the third quarter of next year (Molyneux predicted in April that the project would be fully permitted by the end of 2014) but that seems highly unlikely. Early on, the report states that the project has received its final Nuclear Regulatory Commission license, which is only half-true. Several paragraphs later, there is a rosy discussion of the NRC's Subpart L hearing process before the agency's Atomic Safety and Licensing Board. Missing is an acknowledgment that the ASLB can revoke the license or impose conditions, and even more important, that the ASLB's decision, due in February or March, will certainly be appealed to the NRC's commissioners, and that the commissioners' ruling is likely to be appealed in federal court. Similarly, the MD&A glosses over a long-running dispute between Powertech and the ASLB over the disclosure of massive amounts of geological data possessed by Powertech. Some of the data may support Contention 3 by the Oglala Sioux Tribe and Consolidated Intervenors that the environmental impact statement for the project "fails to include adequate hydrogeological information to demonstrate ability to contain fluid migration and assess potential impacts to groundwater." After much foot-dragging, Powertech finally complied with the ASLB's repeated orders to disclose the data to the intervening parties. The parties hired PhD geologist Hannan LaGarry to analyze the data over the last few weeks. Based on Dr. LaGarry's findings, the intervening parties may seek to introduce new exhibits and testimony into the hearing process. The deadline for such filings is tomorrow, and the evidentiary record for Contention 3 will remain open until the parties have filed all responsive pleadings. November 16, 2014 - Last Wednesday, the penny stock company formerly known as Powertech Uranium Corp. issued its first quarterly financial statements and management discussion and analysis. Although the financials' balance sheet date is September 30, which is prior to the October 28 closing of the reverse takeover by Azarga Resources, the reports reflect the fact that Hongkonger Alex Molyneux and his Azarga crew are in control. Powertech's cash position had dwindled to just $43,913 by the end of September, indicative of the desperate straits that led Powertech CEO Dick Clement to agree to the reverse merger with the better-financed Azarga. The authors of the MD&A waste no time pointing out that the newly-merged company completed a $5 million CAD private placement on October 28. They fail to mention that the bulk of the proceeds came from investors in China ($3.4 million CAD from nine investors) and Japan ($1.1 million CAD from one investor). And missing from the MD&A is any reference to the Blumont Group, Azarga Uranium Corp.'s largest shareholder. The Singaporean penny stock firm owns 30.4% of Azarga Uranium, and will likely increase its ownership percentage through an existing convertible debt deal with Azarga. Blumont and two of its former executives, Neo Kim Hock and James Hong, are currently being investigated by Singapore authorities for suspected false trading and market rigging in a stock market scandal that erased more than $8 billion SGD ($6.9 billion USD) in market value in 2013. November 4, 2014 - If someone stumbled on Azarga's Twitter profile page today, they might get the impression the Asia-based company is a mouthpiece for the Chinese government and nuclear industry (which are one in the same). Three of the seven most recent tweets promote proposed Chinese nuclear power plants and Chinese efforts to export nuclear technology. The other four pertain to the uranium market, the Japanese nuclear power industry, and climate change. None of the seven relate to company-owned uranium assets or plans for increasing shareholder value. This is in contrast to Powertech's historical communications efforts which focused almost exclusively on the Canadian company's uranium holdings and permitting efforts. Powertech was the target of a reverse takeover by Hong Kong firm Azarga Resources Limited. The deal closed last week and the newly-formed company was approved for listing on the Toronto Stock Exchange with the ticker symbol AZZ. November 3, 2014 - Missing from Powertech's October 29 news release announcing the closing of its reverse takeover deal with Azarga Resources was any mention of AZZ's largest shareholder - Singapore penny stock firm Blumont Group Ltd. The fact that Powertech failed to disclose Blumont's 30% ownership stake in the newly-listed Azarga Uranium Corp. is not surprising given Powertech's long history of not disclosing inconvenient information. It was left to Blumont to disclose its acquisition of AZZ shares in a news release, an early warning report on the Toronto Stock Exchange, and an announcement on the Singapore Stock Exchange. The fact that Blumont now owns nearly a third of the proposed Dewey-Burdock uranium project should concern residents of southwestern South Dakota. As Azarga's primary source of financing, Blumont's ownership percentage will likely increase as Azarga issues more convertible debt to the Singapore firm. Blumont is one of eight firms currently being investigated by the Singapore central bank and white collar police for suspected stock manipulation following an October 2013 crash that wiped out $6.9 billion (USD) of market value of Blumont and two other firms. The eight firms are marked by cross-ownership and interlocking boards, and almost 70 people have been brought in for questioning by Singapore authorities. It is not known when the results of the investigation will be released. October 31, 2014 - Day one trading of AZZ on the Toronto Stock Exchange was uneventful. The new ticker opened at $0.35 CAD, reflecting the 1 for 10 reverse stock split undertaken as part of the reverse takeover of Powertech by Azarga Resources. Powertech/Azarga officials didn't explain why the reverse stock split was done, but it is likely the TSX required it as part of its approval of the new listing for AZZ. There is a stigma attached to doing a reverse stock split, as it underscores the fact that shares have declined in value, so AZZ may see increased selling pressure in the days to come. The market cap of the combined company increased to $20.8 million CAD from Powertech's market cap of $5.4 million CAD at the close of trading yesterday. Translated to US dollars, the new market cap is only $18.5 million, a significant drop from the $26.8 million pro-forma market cap included in Powertech's September 2014 investor presentation touting the Azarga deal. Thus, in spite of the merging of the various uranium assets held by Powertech and Azarga Resources (none of which are permitted for production), the new Azarga Uranium Corp. still resides firmly in the penny stock/nanocap investing universe. October 30, 2014 - After finally gaining the approval of the Toronto Stock Exchange for a new listing under the ticker AZZ (seriously?), newly-branded Azarga Uranium Corp. will make its debut on the TSX tomorrow morning, according to an exchange bulletin posted today. The reverse takeover of Powertech Uranium Corp. by privately-held Azarga Resources Limited was originally scheduled to close July 31, but was delayed twice and finally closed yesterday. The deal is referred to as a "backdoor listing" by the TSX since it allows a private company to become listed on the TSX by taking over a troubled public company, thus avoiding an inital public offering. Powertech did not disclose the reasons for the delays, but they may have been due to difficulties meeting the TSX's listing requirements related to financial position and disclosure. Contingent on the closing of the reverse takeover, Azarga also announced the release from escrow of proceeds from a $5 million private placement, but no information on the investors was disclosed. And the new company announced a 1 for 10 reverse stock split to raise the stock price in an effort to enhance the "marketability" of the shares. Finally, the longtime Powertech website went dark today and was replaced by a shiny new Azarga website that appears to carry on the Powertech tradition of half-truths and misleading information. On the TSX today investors seemed to be underwhelmed by all the news as Powertech's stock price dropped to 3.5 cents (CAD). October 25, 2014 - Powertech's efforts to avoid disclosure of critical geological data continue, but the Canadian penny stock firm lost a major battle this week. On Wednesday, the NRC's three Atomic Safety and Licensing Board judges granted a 30 day extension to the Oglala Sioux Tribe and Consolidated Intervenors to review 6,000 borehole logs and related data, and to submit additional testimony and exhibits on the intervenors' Contention 3. The intervenors also have the right to file new contentions if certain standards are met. The intervenors had requested an extension to January 9, but Powertech had opposed any extension. The ASLB settled on an extension that runs through November 21. The judges also reprimanded Powertech for violating federal regulations regarding mandatory disclosure of relevant documents, noting that the ASLB "has been forced to repeatedly rule that data it found relevant to Contention 3 must be disclosed." Although disclosure has been ordered, only NRC staff and intervening parties can look at the data since Powertech successfully argued that the data are proprietary and confidential under federal regulations. Consequently, the intervenors' expert, Dr. Hannan LaGarry, will analyze the borehole logs in Powertech's Edgemont office under the watchful eye of Frank Lichnovsky. Lichnovsky is Powertech's Chief Geologist and has been assigned to keep tabs on LaGarry and provide detailed reports to Powertech officials, as evidenced in an affidavit filed with the ASLB. After Dr. LaGarry's preliminary review of the data, he testified that the newly disclosed data "may provide a sufficient number of data points for me to create stratigraphic cross sections and geologic maps that support the Oglala Sioux Tribe and Consolidated Intervenors' position that there is a lack of adequate containment", referring to the argument that Powertech has not demonstrated the ability to contain radioactive and toxic fluids in the mined aquifers. October 23, 2014 - The more things change, the more they stay the same, particularly when it comes to Powertech/Azarga's investor communications. Tuesday evening, Azarga officials were positively giddy as they tweeted out "Toronto Stock Exchange approved our merger..." and "$5m cash in the can and the highest grade project among US ISR peers". The next day, Powertech issued a news release that was more specific and not quite as upbeat. According to the release, the TSX "conditionally approved" the "merger" between Powertech and Azarga, the proposed $5 million private placement, and a proposed one for ten reverse stock split. True to form, Powertech did not fully disclose the TSX's conditions, only mentioning a four month lock-up period on shares issued pursuant to the private placement. And describing the transaction between Powertech and Azarga as a "merger" is misleading. The actual written agreement between the companies correctly describes it as a reverse takeover of Powertech by Azarga. The TSX refers to these transactions as "backdoor listings", because a privately-held company (Azarga) bypasses the initial public offering process and assumes the public listing of the target company (Powertech). TSX rules consider a transaction to be a backdoor listing if the transaction results in the existing shareholders of the listed company (Powertech) holding less than 50% of the voting power in the new entity, and if there is a change in effective control. In the proposed Powertech/Azarga deal, existing Powertech shareholders will be left with only 33% of the company, and control will shift to a handful of Azarga executives as well as controversial Singaporean firm Blumont Group. The fine print disclaimer on Powertech's news release notes that Powertech "expects" and "assumes" that "the TSX will approve the proposed transaction", implying that final approval has not occurred, and conflicting with the definitive statement made on Azarga's Twitter page. Perhaps this is why on the same day the news release was issued, Powertech's stock price dropped to an all-time low of three cents. One might expect that demand for Powertech shares would increase on the news, but the opposite was true. And today, the stock price rose to only 3.5 cents as a mere 30,000 shares were traded, worth only $1,050 CAD. October 13, 2014 - The Oglala Sioux Tribe and Consolidated Intervenors have begun the process of reviewing borehole logs and other drilling data that Powertech was ordered to disclose by the NRC's Atomic Safety and Licensing Board judges. Powertech fought for several weeks to withhold the data from opponents of the proposed Dewey-Burdock uranium leach project, but ultimately failed to convince the judges that the data are not relevant to the intervenors' contention that Powertech has failed to demonstrate an ability to contain mining fluids and prevent contamination of ground water aquifers. Powertech was able to obtain a license from the NRC staff by submitting only a small subset of the borehole data in its possession and by making sweeping generalizations based on the limited data. In one particular case, Powertech and one of its key experts advanced a hydrogeological argument that appears to be at odds with a long-standing conclusion by federal scientists working for the Tennessee Valley Authority. Last month, PhD geologist Hannan LaGarry traveled to Powertech's office in Edgemont, South Dakota to conduct a preliminary review of the data, contained in 27 boxes and 5 file cabinets. Working on behalf of the Oglala Sioux Tribe and the Consolidated Intevenors, LaGarry estimates that he and two assistants would need 12 weeks to thoroughly review the data to develop a better understanding of the stratigraphy and geology of the proposed project area. Last Thursday, the intervenors filed a motion with the ASLB requesting an extension of time to January 9 to file supplemental testimony and any new or amended contentions pertaining to the borehole data. Powertech is expected to file a response objecting to the extension in the next day or so. October 10, 2014 - Powertech issued a news release today "clarifying" its September 18 news release announcing an updated investor presentation. The presentation and September news release heavily promote Azarga Uranium Corp., a new company to be formed from the proposed reverse takeover of Powertech by Azarga Resources Limited. The September news release included a statement about "the recently completed capital raising and merger with Azarga Resources Limited". Problem is, the capital raising and merger haven't happened. Powertech claims to have escrowed an unspecified amount of funds "related to the $5.0 million private placement", but the financing is contingent on the closing of the reverse takeover, which has been delayed twice. It is not clear if Powertech officials were intentionally trying to mislead investors or if the release was just poorly written. Either way, today's correction was probably ordered by Canadian securities regulators or the Toronto Stock Exchange, which has still not approved an exchange listing for the new company. Since Azarga began accumulating Powertech shares last year, the Hong Kong company appears to have become increasingly involved in Powertech's investor communications and regulatory filings. And starting in February of this year, Powertech news releases have included contact information for Azarga's manager of investor and public relations. The manager, Jenya Mesh, is a model and, according to her Twitter profile, a "global dominator". October 9, 2014 - Today the Black Hills Clean Water Alliance issued a news release regarding a recent announcement by the Region 8 office of the U.S. Environmental Protection Agency that may affect the proposed Dewey-Burdock project. The EPA noted that it has completed a Preliminary Assessment (PA) of the Darrow/Freezeout/Triangle abandoned uranium mines located north of Edgemont, South Dakota. The abandoned mines are within and adjacent to the proposed Dewey-Burdock project, and the EPA's review of environmental data collected by Powertech found radioactive and heavy metal contamination of the air, surface soils, surface water, and ground water. Based on the assessment, the EPA plans to conduct a site investigation in 2015 to determine if hazardous substance releases from the abandoned mines are impacting sensitive environments and posing a risk to nearby residents and workers. The investigation could potentially result in a Superfund designation of the sites under the Comprehensive Environmental Response, Compensation, and Liability Act. The PA was triggered by a petition filed by the non-profit Institute of Range and the American Mustang, owner of the Black Hills Wild Horse Sanctuary. The EPA's announcement indicates the PA is separate from Region 8's expected decisions on underground injection control permits for the proposed Dewey-Burdock project, although it is hard to see how this investigation won't have some impact on permitting for the project. It is not clear if the EPA's announcement had anything to do with yesterday's 30% drop in Powertech's stock price to an all-time low of $0.035 CAD. The share price bounced back to close at $0.045 CAD today, but it remains depressed as Dewey-Burdock permitting woes persist and the company seems unable to gain approval from the Toronto Stock Exchange to list the new firm resulting from the proposed reverse takeover of Powertech by Hong Kong firm Azarga Resources. (For the full 10 MB PDF of the EPA's Preliminary Assessment Report, click here.) September 29, 2014 - Perhaps the most questionable assertion made by Powertech in its recent investor presentation is that the proposed merged company, Azarga Uranium, will have a market capitalization of $29.5 million CAD. This wildly optimistic market cap, calculated by multiplying an expected share price of $0.05 by 589 million projected outstanding shares, has absolutely no supporting detail in the presentation. The "pro forma" market cap assumes that the reverse takeover of Powertech by Azarga Resources will actually occur, even though the closing date has been delayed twice and the new company may be having difficulty meeting the Toronto Stock Exchange's listing requirements. Since Powertech's current market cap was only $7 million CAD when the presentation was released earlier this month, Powertech and Azarga officials apparently believe that Azarga's net assets brought to the combined company are worth over $22 million CAD. Even a cursory overview of Azarga's assets belies such a valuation. Azarga's primary asset is its 80% stake in the Kyzyl Ompul Project in Kyrgyzstan. While the presentation repeats the claim that it is the largest known uranium deposit in the country, the project actually consists of just an exploration license that expires in December 2015. The technical report on the project notes that Azarga's Kyrgyz subsidiary "has advised that access to the property may be limited due to the roads being blocked by the local population and that the area had a history of political unrest during 2005 and 2010." Even Azarga promoter and investment writer Peter Epstein warns that Kyzyl Ompul "is blue-sky upside potential" and not a core focus of the company. Other Azarga assets, including a 60% interest in Powertech's Centennial project and a 19% interest in Black Range Minerals' Hansen/Taylor Ranch, both in Colorado, also carry significant permitting and technical risks. Even Powertech officials have privately described Azarga's assets as "worthless", according to someone with knowledge of the matter. September 26, 2014 - Dilution of existing Powertech shareholders continues unabated as both Powertech and Azarga Resources issue more shares. On July 9, Powertech issued 1,745,902 shares to Energy Fuels Resources (USA) Inc. as partial payment for drill hole electric logs, maps, and digital data. On August 26, Powertech issued 888,655 shares to an unnamed U.S. party. Since Powertech did not disclose the issuance in a news release, the recipient of the shares and the reason for the issuance are unknown. Azarga issued 1,029,386 shares sometime in early to mid 2014 to an unnamed party. And on September 11, Azarga converted debt and issued a whopping 38,212,493 shares to the Blumont Group Ltd., boosting the Singaporean firm's ownership of Azarga to 43.1%. Under the terms of the proposed reverse takeover, Powertech will issue and exchange 3.65 shares for each Azarga share, leaving existing Powertech shareholders with about 14% of the new company. The dilution is occurring as Powertech, Azarga, and their promoters are making a concerted effort to boost Powertech's stock price and attract new investors by implying that a "3x re-rating" (increase) of the trading valuation of the merged company is likely, even though the takeover has been delayed twice and the claimed resource estimates are questionable. September 25, 2014 - One of the important takeaways from Powertech's new investor presentation has to do with who would control and influence the new Azarga Uranium Corp. The proposed reverse takeover of Powertech by Azarga Resources has been delayed twice and may not overcome regulatory hurdles from the Toronto Stock Exchange. But if the deal does close, it is unclear who will control the new company. The investor presentation notes that the largest shareholder will be Singaporean firm Blumont Group Ltd. with a 30.7% stake. Azarga insiders, led by CEO Alex Molyneux, will control 31.8% of the new company. Ownership by current Powertech CEO Dick Clement and other Powertech officials will be diluted to an insignificant amount. Blumont's ownership is likely to increase if Azarga Uranium issues more convertible debt to the Singaporean firm. What the presentation fails to mention is the ongoing, unprecedented investigation of Blumont by Singapore's white collar police unit and central bank following a 95% drop in Blumont's stock price in October 2013. Investigators are probing possible breaches of the Singapore Securities and Futures Act. And Powertech is silent regarding Blumont's financial connections to New York hedge fund Platinum Partners and its controversial manager Meir "Mark" Nordlicht. Nordlicht appears to be the primary financier of Blumont and has been a key figure in major financial scandals in recent years. September 23, 2014 - Last Thursday, Powertech released a new investor PowerPoint presentation that touts the merger of Powertech with Azarga Resources. One slide includes the statement that "merger finalization expected mid-October" but fails to mention that the closing of the merger, actually a reverse takeover by Azarga, has been delayed twice. The closing was originally scheduled for July 31. The delays are presumably due to challenges in gaining approval of the Toronto Stock Exchange. Because the TSX treats a reverse takeover as a new listing, Powertech/Azarga must meet the exchange's listing requirements for "non-exempt (less established) exploration and mining companies". The problem is that the new Powertech/Azarga may not meet key listing requirements, specifically, the minimum requirements for working capital and net tangible assets. To be even close to meeting both requirements, Powertech/Azarga will have to raise the entire $5 million from a recently-announced private placement offering. But the private placement is contingent on the closing of the reverse takeover, and approval of the reverse takeover is contingent on meeting the listing requirements. Stay tuned...(Interestingly, the TSX looked the other way for years while Powertech failed to meet its listing requirements.) September 22, 2014 - After recently interviewing Azarga CEO Alex Molyneux, blogger and Powertech shareholder Peter Epstein posted a promotional article urging investors to purchase Powertech shares. Epstein assumes the Azarga/Powertech merger will go through, and claims that all permits for the proposed Dewey-Burdock project are expected to be in place within nine months. He fails to mention the ongoing contested hearing process on the Nuclear Regulatory Commission license, and the likelihood that any late-2014 decision by the NRC's Atomic Safety and Licensing Board will be appealed to the commission and then to federal court. Epstein glosses over the multiple permits that must be obtained from the Environmental Protection Agency and the South Dakota Department of Environment & Natural Resources and the attendant appeals and judicial processes. And he completely omits any mention of the Plan of Operations Powertech must obtain from the Bureau of Land Management, which may also land in federal court. |

Powertech shareholders

approve reverse takeover by Australian and Singaporean investors

Posted July 20, 2014

Alexander Molyneux’s ownership of uranium mining properties as of July 4, 2014 (PDF 209 KB, 1 page) This updated chart corrects certain corporate relationships disclosed in Powertech's May 13 Information Circular, and reflects recent share purchases of Black Range Minerals.

AZARGA TO TAKE OVER POWERTECH

Hong Kong dealmaker Molyneux to take control of Powertech in reverse takeover of troubled Canadian firm; Molyneux and other Azarga shareholders to own 77% of new Azarga Uranium Corp.; permitting risk at Dewey-Burdock cited

Posted March 8, 2014

Form 51-102F3 MATERIAL CHANGE REPORT - Powertech Uranium Corp. - March 6, 2014 (PDF 24 KB, 6 pages)

SHARE PURCHASE AGREEMENT between POWERTECH URANIUM CORP. and AZARGA RESOURCES LIMITED - February 25, 2014 (PDF 226 KB, 65 pages) Includes list of Azarga shareholders (Schedule A).

Colorado regulators: "Quite clearly the project was abandoned by Powertech"

Posted February 3, 2014

Clement writes down Centennial project by $12.3 million in questionable accounting move

Delayed writedown may have misled investors; is new value still inflated?

Posted January 9, 2014

Powertech sells 60% of Centennial project to Hong Kong investment firm; inexperienced Chinese company becomes largest Powertech shareholder

Posted October 13, 2013

Powertech corporate filing describes Centennial project as "not material to the company" for the first time

Rare admission by Canadian company confirms that survival of company hinges on Dewey-Burdock

Posted July 9, 2013

For the first time, Powertech has admitted that the proposed Centennial project in northern Colorado is not material, meaning that the project's importance to the Canadian uranium company has declined significantly.

The admission comes in the March 28, 2013 Annual Information Form filed with Canadian securities regulators. Centennial has always been touted as one of Powertech's two flagship projects along with the proposed Dewey-Burdock project in South Dakota.

The filing lumps Centennial in with Powertech's Wyoming exploration prospects, which are also described as immaterial. No permitting activities are being conducted for Centennial or any of the Wyoming properties.

The AIF's description of the Centennial project consists of a brief three paragraphs sandwiched between a lengthy description of the Aladdin project (Crook County, WY) and descriptions of Powertech's other Wyoming prospects (Dewey Terrace, Colony, and Savageton).

This marginalization of the Centennial project in an official communication to investors comes two years after the project was reported as being "mothballed" by the Fort Collins Coloradoan newspaper and one year after the dismissal of Powertech's lawsuit against the State of Colorado over new uranium mining regulations.

Powertech still appears unable to provide investors with a complete and accurate account of Colorado House Bill 1161, adopted in 2008. The AIF correctly notes that the legislation creates a "specialized regulatory regime" for in-situ leach uranium mining, but goes on to assert that "this new law could, upon implementation, establish standards for in-situ recovery mining and restoration that may ultimately affect the profitability of the Centennial Project".

Powertech fails to mention that the standards have already been established during a two-year rulemaking process that the company was a party to. After the rulemaking didn't go Powertech's way, it sued the state. The lawsuit was thrown out by the judge in July 2012.

None of these details are disclosed in Powertech's AIF.

It is not surprising that Powertech would take its time to let investors know that they should not rely on the Centennial project for future cash flows to the Canadian company. We will see how Powertech handles its disclosures regarding Centennial in its upcoming second quarter filings due August 14, and whether it finally tests its capitalized Centennial costs for impairment as required under international accounting rules.

And it will be interesting to see if Powertech finally admits that the proposed Dewey-Burdock project will not be fully permitted by the end of this year, and if it discloses the NRC's Subpart L hearing process and the potential for appeals of any injection well permits issued by the Environmental Protection Agency.

JW

Powertech puts more Centennial land up for sale

Canadian company lists key land positions with local realtor in attempt to raise cash

Posted June 27, 2013

Powertech recently listed three more properties for sale located near the center of the moribund Centennial uranium project. As the Canadian company edges toward insolvency, selling its limited real estate holdings may be the only way to raise cash.

Powertech's share price has hovered between six and seven cents (Canadian) for the last several weeks. Powertech's last equity financing round was at a share price of $0.10 CAD in February of this year, and the company was only able to raise $1.5 million CAD. (Investors received one share purchase warrant with each common share.)

Powertech's cash burn rate for the first quarter of 2013 was $350,000 per month. At March 31, Powertech's cash position was only $951,115. If Powertech has been able to trim its cash disbursements to $300,00 a month, it should have less than $100,000 in the bank at the end of this month.

Powertech listed the three parcels with Wellington, Colorado brokerage ReQuest Real Estate Services. The three properties, totaling 157.5 acres, are located in Section 15, Township 9, Range 67 West between the towns of Wellington and Nunn, Colorado.

Section 15 is located near the center of the proposed Centennial project, which was suspended by Powertech after the company lost its legal case against the state of Colorado seeking to overturn new uranium mining regulations.

One of the seven major orebodies of the Centennial project is located roughly in the center of Section 15.

Section 15 is also noteworthy for the fact that three families who were instrumental in forming Coloradoans Against Resource Destruction (CARD) live and own property within its boundaries. CARD is a grassroots group with the mission of protecting local ground water and other resources

The three families control 37% of the land area of Section 15 (about 237 acres), and since Powertech announced the uranium mining project in 2006, none of the families have signed a surface use agreement with the Canadian company.

Powertech purchased the right to mine uranium on Section 15 from Anadarko Land Corp. in 2006. When a split estate exists (minerals and surface ownership), a mining company must negotiate a surface use agreement with the surface owners before mining can occur.

CARD's accomplishments include the passage of Colorado House Bill 08-1161, the 2008 legislation designed to protect ground water from in-situ leach uranium mining, and the adoption of resolutions of opposition to ISL uranium mining by several nearby municipalities including the city councils of Fort Collins and Greeley.

Since 2007, Powertech has purchased roughly a dozen parcels in the proposed Centennial project area. In December 2012, Powertech sold one of its Section 15 properties and lost over $100,000 on the transaction.

The three properties currently for sale include a 44.1 acre parcel that Powertech has listed for $99,000. The Canadian company purchased the property in May 2007 for $125,000.

The second parcel is 34.4 acres and is listed for $85,000. Powertech purchased the property in May 2007 for $79,900.

The third property is 79 acres and is priced at $120,000. Also acquired in May 2007, Powertech paid $250,000 for the parcel. The sellers, S & J Company, bought the property a year earlier for $82,000.

It is likely that a condition of any sale would be Powertech's retention of certain surface rights for future uranium mining. The real estate advertisement for the 34.4 acre parcel notes the inclusion of a ground water monitoring well without disclosing that this well is part of a proposed uranium mining project.

The ad for the 80 acre property describes it as an "interesting development opportunity" and notes that the "sale requires perpetual easement for current seller to monitor water quality via monitoring well".

None of the three ads mention possible future uranium mining or that the owner/seller is a Canadian uranium company.

JW

Advertisement for 44.1 acre property

Advertisement for 34.4 acre property

Advertisement for 79 acre property

Maps of the Centennial Project

Short lead times to production? Powertech's marketing pitch doesn't hold up

Posted June 2013

On the Powertech website, company officials claim that the Canadian company "minimizes risk by acquiring known deposits with short lead times to production". Powertech, formed in mid-2005, has yet to produce a single pound of uranium. Nearly eight years after securing an option to lease the surface and mineral rights to develop the Dewey-Burdock uranium project, Powertech has yet to obtain a single federal or state license or permit to mine uranium.

JW

THE SORDID HISTORY OF IN-SITU LEACH URANIUM MINING

License violations at Highland ISL uranium mine, Wyoming

License violations at Smith Ranch ISL uranium mine, Wyoming

License violations at Crow Butte ISL uranium mine, Nebraska

License violations at Willow Creek (formerly Christensen Ranch/Irigaray) ISL uranium mine, Wyoming

Geologist Bonner: Centennial project is still active

Posted February 22, 2013

Powertech Vice President of Exploration Jim Bonner insists the company's proposed northern Colorado uranium project is still active, according to a February 6 article in the Fort Collins Coloradoan by reporter Bobby Magill.

Bonner made the assertion despite the fact that the Canadian company has publicly announced the suspension of the Centennial project, ceased all permitting activities in December 2011, lost its two-year-long lawsuit against the state of Colorado over new uranium mining regulations, closed its northern Colorado office in August 2011, and failed to exercise options to purchase sizable land positions with significant uranium resources.

Moreover, Powertech has begun selling project real estate and plugging exploration boreholes. It admitted in a regulatory filing that a significant portion of the project's uranium is not recoverable by standard in-situ techniques, and the company has less than $1 million in the bank, all of which is earmarked for its sole remaining project in South Dakota.

In an interesting choice of words, Bonner told Magill that "Centennial is still an active project on the books" (emphasis added). Bonner's implication is that the $15 million of Centennial project costs that remain on Powertech's balance sheet are a legitimate asset even though all evidence points to the conclusion that the project is dead and is unlikely to ever be resuscitated.

The point is more than academic since International Financial Reporting Standards require Canadian public companies to write down "impaired assets". If facts and circumstances suggest that Powertech may never recover the $15 million it has invested in Centennial, the company must test for impairment. And If impairment is determined, it is required to measure, present and disclose an impairment loss on its income statement.

Publicly-traded companies, particularly cash-strapped penny stock firms such as Powertech, have an incentive to avoid asset write-downs due to the potential adverse reaction of shareholders.

Powertech has never done an analysis to determine if the Centennial project asset is impaired, and it will be interesting to see if Powertech and its Canadian auditors, BDO Canada LLP, address the issue in year-end financial statements which must be issued by April 2.

JW

Powertech begins to plug and abandon monitoring wells at Centennial site

Posted January 12, 2013; Updated January 17, 2013

Powertech Uranium Corp. has started to plug and abandon wells the Canadian company drilled at the proposed Centennial uranium mining site near Fort Collins, Colorado. In a January 2 letter to the Colorado Division of Water Resources (DWR), Powertech VP of Exploration Jim Bonner explains that the four plugged wells "were no longer of any use to Powertech".

The wells were drilled in August and September of 2007 under two "Notice of Intent to Construct Monitoring Hole(s)" forms submitted to the DWR in July 2007. Powertech did not obtain actual well permits from the DWR until October 7, 2008. The wells were intended for use during aquifer pump tests.

Powertech plugged the four wells on November 6-7, 2012.

Plugging and abandonment of Centennial project wells is not surprising since Powertech has ceased all permitting activities, closed its project office, and started selling project real estate. Moreover, the Canadian company recently lost its lawsuit seeking to overturn new Colorado uranium mining regulations.

In spite of all the evidence that the project is in decline, Powertech continues to mislead investors about its status. For instance, Powertech's current corporate presentation available on its website avoids any mention of the actual status of the project, focusing instead on questionable financial projections and resource estimates.

In addition, Powertech has so far failed to disclose any serious analysis of expected cash flow from the project and whether the project needs to be written down on the company's financial statements.

Powertech's website calls Centennial a "flagship property" with a "short lead time to production". Powertech acquired the mineral rights on September 27, 2006 and has yet to file a major permit application for the project.

JW

Letter to Colorado Division of Water Resources providing notification of plugging and abandonment of four monitoring wells at the Centennial uranium project - James A. Bonner, Vice President of Exploration, Powertech (USA) Inc. - January 2, 2013 (PDF 624 KB, 8 pages)

POWERTECH QUITS LEGAL FIGHT AGAINST COLORADO MINING REGULATIONS

Canadian firm loses litigation after failure to appeal dismissal order

Posted January 1, 2013

Attorneys for Powertech Uranium Corp. will not be filing an appeal of a judicial order dismissing the company's lawsuit against the State of Colorado, according to someone with knowledge of the matter. This marks the end of an over two-year legal effort by the Canadian start-up company to overturn strict new regulations governing in-situ leach uranium mining.

An attorney from Powertech's Denver law firm, Fognani & Faught, PLLC, recently told a representative of the Colorado Attorney General's office that an appeal was not forthcoming, according to the source. All deadlines for filing a notice of appeal have passed.

The deadlines were apparently extended after attorneys from Fognani & Faught missed the original deadlines and later filed a motion alleging the July 13, 2012 order dismissing the case was never properly signed by former Denver District Court Judge Christina Habas. Judge Habas retired from the bench on the same day the order was issued.

Judge Habas dismissed the case because "Powertech has failed to meet its burden in establishing the allegations contained in its Complaint", according to the July 13 order.

Powertech's attorneys made several legal arguments against the 2010 rules promulgated by the Colorado Mined Land Reclamation Board, none of which were ultimately successful.

In April 2011, Powertech CEO Dick Clement revealed that the decision had been made to put the Centennial project on hold and to focus on the proposed Dewey-Burdock project in South Dakota. It remains to be seen if the cash-strapped Canadian company can obtain the myriad permits needed for Dewey-Burdock, and whether returning to Colorado and the Centennial project is a viable option.

Company observers will be awaiting Powertech's year-end audited financial statements to see if the company discloses the terminated litigation, and whether an impairment loss is taken on the project.

JW

Centennial project land sold to raise funds for Dewey-Burdock

Posted December 20, 2012

Powertech has sold a 35-acre parcel with a home that it acquired in 2007 along with several other properties, according to Weld County property records. The sale marks the first disposition of land once considered essential to the proposed Centennial uranium project in northern Colorado.

The property at 51955 County Road 21 is located within the proposed permit boundary for the project and is one of 17 parcels acquired by Powertech since 2007, according to a surface ownership map Powertech submitted to the Environmental Protection Agency in 2010.

Powertech conducted exploratory drilling on the property in 2007.

Powertech sold the property in early November for $235,000. The Canadian company paid $340,000 for the property in 2007. It is likely that Powertech retained the mineral rights, and it is unknown whether a surface use agreement was executed with the new owners.

Presumably, Powertech sold the property because it included a fairly new single-family home and would generate more cash to help finance its permitting efforts in South Dakota. It is noteworthy that Powertech's financial position is so dire that it would sell part of what was once a flagship project to raise a relatively small amount of cash.

JW

Hyper-technicality or nefarious action by district court clerk?

Posted November 2, 2012

Recent court filings in Powertech (USA) Inc. v. State of Colorado Mined Land Reclamation Board:

FRIVOLOUS LITIGATION?

Powertech's claim that Judge Habas didn't sign order dismissing lawsuit shown to be groundless

Posted October 4, 2012

|

| Former Denver District Court Judge Christina M. Habas |

A copy of the July 13 court order dismissing Powertech's case against the Colorado Mined Land Reclamation Board clearly shows the signature of former Denver District Court Judge Christina M. Habas. In an October 1 motion filed by attorneys from Fognani & Faught, PLLC on behalf of Powertech, the Canadian company makes the assertion that Judge Habas never signed the order.

The motion appears to be an attempt to reopen the appeal window after Powertech and its attorneys let the deadline lapse on August 27. The lawsuit was the culmination of a multi-year effort by Powertech to stop or overturn new Colorado rules designed to protect groundwater quality and enhance public participation in permitting decisions for uranium prospecting and mining.

The copy of the signed order comes from the Colorado Attorney General's office, which received it on September 11. Attorneys from the AG's office represent the Mined Land Reclamation Board.

Court rules require that attorneys investigate the factual basis for any claim to avoid wasting the court's and other parties' time and resources. It is unclear why Powertech's attorneys apparently did not obtain a copy of the signed order before filing the motion.

Since the motion appears to have no underlying justification in fact, Powertech could choose to withdraw the filing. If it does not, the Attorney General and intervening parties will respond and the Court will rule on the motion.

JW

Desperation move?

Powertech attorneys attempt to reopen appeal period by claiming judge's dismissal order was never signed

Posted October 2, 2012

|

| Attorney Paul G. Buchmann, Fognani & Faught, PLLC |

Five weeks after the deadline for filing a notice of appeal, Powertech's attorneys have filed a motion attempting to resuscitate the Canadian company's ill-advised lawsuit against the State of Colorado over new uranium mining regulations. The motion was filed yesterday in Denver District Court.

When the August 27 deadline passed, most observers concluded that Powertech had decided to throw in the towel on the lawsuit. This seemed logical given the judge's dismissal of the action because "Powertech has failed to meet its burden in establishing the allegations contained in its Complaint", according to the Court's order.

However, others with knowledge of the case speculated that Powertech's Denver law firm, Fognani & Faught, PLLC, may have intended to file a notice of appeal, but inadvertently let the appeal period lapse.

If true, Fognani & Faught may have been strongly motivated to find a way to preserve Powertech's right to appeal the Court's dismissal of the case. Hence, yesterday's motion.

The motion, signed by junior attorney Paul Buchmann, asserts that Judge Christina Habas never signed the dismissal order, and that an unsigned order means that judgment in the case was never entered. Buchmann requests that the Court sign the order, thereby reopening the period for filing an appeal.

The only problem for Powertech and Fognani & Faught is that Judge Habas did sign the July 13 dismissal order, according to someone with knowledge of the case. A copy of the signed order is reportedly in the possession of the attorneys for the defendant, the Colorado Mined Land Reclamation Board.

It appears likely that Powertech's motion will be unsuccessful and that the dismissal of the case will stand. The Court's dismissal does not bode well for the future of the Centennial project, since Powertech has expressed strong objections to many of the new uranium mining rules.

Despite this, Powertech continues to tell investors that the project is temporarily on hold, and that it will be reactivated when its proposed Dewey-Burdock project in South Dakota is permitted and begins to generate revenue. Final licensing for Dewey-Burdock is not expected until 2014 at the earliest.

JW

POWERTECH FOLDS

Canadian company doesn't appeal the dismissal of its lawsuit against new Colorado uranium mining rules; is the Centennial project dead?

Posted August 29, 2012

Powertech Uranium Corp. has apparently decided to not appeal the July 13 dismissal of its lawsuit challenging new Colorado rules regulating in-situ leach uranium mining.

Soon after announcing the proposed Centennial ISL uranium project in 2007, Powertech assured local Weld County, Colorado landowners that it could conduct ISL uranium mining and restore groundwater aquifers to pre-mining water quality.

But when northern Colorado residents and legislators sought to incorporate this concept into state law, Powertech sang another tune. The Canadian company vigorously opposed the 2008 legislation that eventually passed by overwhelming bipartisan majorities, and fought subsequent regulations drafted by the Colorado Mined Land Reclamation Board.

After the MLRB unanimously adopted the rules on August 12, 2010, Powertech filed a lawsuit seeking to overturn them. After delays by Powertech, the case was finally dismissed on July 13 of this year.

The deadline for filing a notice of appeal with the district court was Monday, August 27. A second deadline for filing a notice of appeal with the appellate court is Friday, August 31. Since both filings are required in this case, one can assume that Powertech has missed the Monday deadline and therefore is not appealing the judge's dismissal order.

The decision to not appeal is one more indication that Powertech has given up on the controversial Centennial project. In the last year, Powertech has directed federal and state regulators to cease all permitting activities, closed its Wellington, Colorado project office, transferred or laid off the project manager and support staff, allowed key land options to expire, listed project real estate for sale, and announced that it is shifting its attention and resources to the proposed Dewey-Burdock project in South Dakota.

However, Powertech is unlikely to publicly admit that it has terminated the project since it wants investors, Canadian broker-dealers and hedge fund managers, and potential acquirers and "strategic partners" to think the Centennial project is still an economically-viable uranium project.

JW

Powertech's July 2012 investor presentation rife with misleading claims, omissions, and contradictions

| Powertech claim | Comment |

| The company has a "revitalized capital structure". | While Powertech was able to issue new stock and restructure its debt to Belgian company Synatom in March 2011, it has since burned through most of its cash and could be insolvent by the end of the year without new financing. |

| Slide 3 includes the claim that Powertech has "world-wide uranium expertise" of 200+ years. Slide 20 states that the company has greater than 150 years of experience as "uranium finders, permitting, and design, construction & operation. | Nowhere in the presentation does Powertech mention that co-founder and former chairman and COO Wallace Mays left these positions. Mays considered Powertech to be his company, and most of Powertech's international and domestic uranium experience was attributable to Mays. |

| Dewey-Burdock project permits and license applications have been filed. | Powertech has not yet submitted a Large Scale Mine Permit application to the State of South Dakota. This is one of the three major permits/licenses needed for the project. (Note: This permit application was filed on October 1, 2012.) |

| Centennial project permit applications are "ready to be completed and filed". | This claim is particularly misleading since Powertech has directed the U.S. EPA and the State of Colorado to cease all permit application review activity. All permitting activity on the project has been suspended. |

| Slide 3 includes the claim that the company has a "large uranium base" of 16.2 million pounds of "indicated" resources and 6.6 million pounds of "inferred" resources. | Powertech fails to mention on this slide that it used different uranium price assumptions to calculate the resource estimates for the two projects. A more aggressive assumption for the Centennial project resulted in a higher resource estimate. |

| Powertech has other "advanced exploration properties for future development". | Of the three "advanced exploration" properties, Aladdin, Dewey-Terrace, and Powder River Basin (all in Wyoming), Aladdin is the only property with a NI 43-101 compliant technical report, but the report has numerous shortcomings as reported on this website. |

| The company had cash of $3.2 million CAD as of March 31, 2012. | The presentation was released in July 2012. There is no reason why Powertech should not have reported its cash position as of June 30, 2012, which was only $1.9 million. |

"Located just 10 miles from the booming college town of Fort Collins, the proposed Centennial mine is unusual for a North American uranium project in that it’s close to a population center. Most of the mines worked in the 1950s and ‘60s were in southwestern Colorado, a region of mesas, deep river canyons, and few people." from "The Uranium Boom Hits Western U.S." by Richard Martin, energytribune.com, May 19, 2008. Energy Tribune is a website providing news and analysis to investors in energy stocks.

CASE DISMISSED

Powertech's lawsuit challenging new Colorado uranium mining rules is thrown out by judge; court rejects each and every argument raised by Canadian company; C.A.R.D. co-founder calls on Powertech to formally abandon Centennial project

Posted July 13, 2012, Updated July 22, 2012

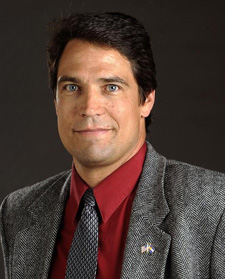

|

| Powertech CEO Dick Clement pushed the failed lawsuit against the State of Colorado. Clement had not read the court's decision as of July 16, three days after it was issued, according to one reporter. |

"Judge dismisses Powertech's lawsuit" by Cathy Proctor, Denver Business Journal - July 16, 2012

"Powertech mulls whether to appeal Colorado ruling" - Associated Press - July 17, 2012

"State court rejects Powertech lawsuit" by Kate Hawthorne, North Forty News - July 16, 2012

"Colorado: Court upholds rules that protect water from uranium mining and protect right to public involvement" by Bob Berwyn, Summit County Citizens Voice - July 15, 2012 "Efforts by a Canadian mining company to bully Colorado came to naught last week, as Denver District Court Judge Christina Habas upheld state regulations that protect water from in situ leach uranium mining impacts."

|

| Weld County land owner Robin Davis, a co-founder of C.A.R.D. whose ranch is adjacent to Powertech’s proposed mine site, praised the ruling. “Powertech had told us from day one that they could and would restore our water. Instead of making good on that promise, the company instead sought through the courts to eliminate ground water protections and exclude the public from the process. If it can't fulfill its promises of protecting our precious water supplies, Powertech should formally abandon this risky project.” |

Powertech attorneys file final brief in uranium rules lawsuit

Judge's order expected before July 13

Posted June 23, 2012

Attorneys from Denver law firm Fognani & Faught filed the final brief June 15 in Powertech's lawsuit against the Colorado Mined Land Reclamation Board. The legal action challenges uranium mining rules adopted by the board in 2010.

The case now goes to Denver District Court Judge Christina Habas for a final ruling. Judge Habas has announced her July 13, 2012 retirement from the court; an order ruling on Powertech's case is expected before then.

As the case has unfolded, Powertech's claims have steadily narrowed according to court filings. The Canadian company's original complaint includes a multitude of allegations: First, certain rule language proposed near the end of the rulemaking process did not comply with state statutes requiring a statement of the basis, specific authority, and purpose for the rules. Second, certain state legislators improperly attempted to influence the rulemaking and thus violated the Colorado Constitution's separation of powers. And third, sixteen of the new rules are unreasonable, arbitrary, capricious, vague, unduly burdensome, overreaching, prejudicial, or lacking a basis in law.

A couple of claims were thrown out by Judge William W. Hood III early in the proceedings; many others were simply dropped by Powertech.

In contrast to its 2010 complaint, Powertech's final brief includes only a handful of relatively narrow claims. The company's attorneys argue that four rules drafted near the end of the rulemaking process lacked the required statement of basis and purpose, and that the same rules lacked adequate legislative authority. The four rules address drilling fluid pit liners, baseline water quality testing before exploratory drilling, and public comment and appeal rights related to prospecting and mine permit transfers.

Most notably, Powertech dropped its legal challenge to a series of new rules that implement the core provisions of Colorado House Bill 08-1161. Taken together, the rules place strict limits on the permitting, operation, and reclamation of in-situ leach uranium mining, with an emphasis on protecting ground water quality.

Powertech may consider its remaining claims to be the most promising from a legal standpoint, but overall its lawsuit appears to be running out of gas. In addition to its narrowed scope, the final brief includes few caselaw citations to support the arguments, and it leans heavily on hyperbole. For instance, Powertech attorneys argue that if the judge endorses the challenged rules she will be doing "violence to both the letter and spirit" of the Colorado Administrative Procedures Act and the Mined Land Reclamation Act.

JW

POWERTECH BEGINS TO SELL OFF CENTENNIAL PROJECT ASSETS

Scope of lawsuit scaled back

Powertech's opening brief seeks invalidation of all new Colorado uranium mining rules but only argues against handful of rules added near end of rulemaking

Posted April 27, 2012, Updated May 13, 2012

In a surprising concession, Powertech has backed off its legal challenge of the most critical new uranium mining rules adopted by the Colorado Mined Land Reclamation Board in 2010. The rules were adopted after a lengthy and extensive public rulemaking process and are intended to implement bills passed by the legislature in 2008.

In an opening brief filed on April 11, 2012, Powertech's attorneys present arguments against rules related to five issues that were discussed near the end of the rulemaking process. The issues include pit liners for drilling-related mud pits, notifying local governments of upcoming prospecting/exploration activities, collection of baseline water quality data relating to prospecting, and others.

Powertech argues that these rules "were promulgated without proper notice to the public and an opportunity for hearing, without statutory authority, in an arbitrary and capricious manner and with no scientific or technical basis in the record demonstrating their need to protect public health or the environment."

What is surprising is that Powertech does not argue against the numerous other rules adopted by the Mined Land Reclamation Board. These other rules address the most important elements of the 2008 legislation, including the requirement that an operator must demonstrate by substantial evidence that affected ground water will be reclaimed to premining baseline water quality or better, or to a quality which meets state ground water standards.

Furthermore, Powertech did not challenge the rule requiring an operator to achieve reclamation so that existing and reasonably potential future uses of groundwater are protected.

And no arguments were presented against the rule requiring a permit applicant to provide information about five in-situ leach mining operations that “demonstrate the applicant’s ability to conduct the proposed mining operation without leakage, vertical or lateral migration, or excursion of any leaching solutions or ground water containing minerals, radionuclides or other constituents mobilized, liberated or introduced by the mining operation into any ground water outside of the permitted in-situ leach mining area.”

Throughout the rulemaking, Powertech argued strongly against these rules, claiming that they were unreasonable, impractical, and too costly. None of these arguments made it into the opening brief filed two weeks ago.

Of course, that didn't stop Powertech from requesting that the court invalidate the entire set of rules. In lieu of that, Powertech asks the court to throw out the few rules that were developed near the end of the rulemaking.

The Colorado Attorney General has until May 25 to file an answering brief on behalf of the Mined Land Reclamation Board. It is expected that attorneys Jeffrey Parsons and Travis Stills will file an answering brief for Defendant-Intervenors Coloradoans Against Resource Destruction, Tallahassee Area Community Inc., and Sheep Mountain Alliance.

JW

RULES LAWSUIT DELAYED

Case should be before court by June, assuming Powertech still in business

Posted February 27, 2012, Updated May 13, 2012

District Court Judge Christina M. Habas today issued an order extending the briefing deadlines for Powertech's lawsuit against the Colorado Mined Land Reclamation Board (MLRB). Powertech filed the lawsuit in 2010 in an attempt to reverse new rules governing in-situ leach uranium mining in Colorado.

The rules are intended to protect groundwater from contamination by radionuclides and heavy metals mobilized during ISL uranium mining. The new rules were pushed by Northern Colorado residents and landowners in response to Powertech's proposed Centennial uranium project.

The project would be located less than seven miles from Fort Collins, Colorado, a city of 143,986 people according to the 2010 census.

Although Powertech promotes the ISL process as cheaper and less hazardous, the portion of the Centennial project located closest to Fort Collins would likely have to be mined by the open pit method. The uranium deposits in this area are too shallow for typical ISL mining.

Powertech has floated the idea of "enhancing" the aquifer by pumping in massive quantities of fresh water to create the conditions necessary for ISL mining, but has been unable to point to any other uranium mining operation that has attempted this.

According to a person with knowledge of the case, the extended briefing deadlines mean that the lawsuit will be before the court by June and the court should issue a ruling by late summer.

Powertech must file its opening brief by April 11. The MLRB and intervening parties have until May 25 to file answering briefs. Coloradoans Against Resource Destruction, Tallahassee Area Community, and Sheep Mountain Alliance have intervened in support of the MLRB. No companies or organizations have intervened to support Powertech's lawsuit.

Powertech then has until June 15 to file a reply brief. Following briefing by the parties, the judge will then determine whether the MLRB "exceeded its jurisdiction or abused its discretion" during the rulemaking process. Given the complexity of the case, a decision will likely take several weeks.

Powertech's ability to advance its lawsuit against the MLRB may depend on whether the Canadian firm can line up new financing in the next couple of months. The company had only $5 million in cash as of September 30, 2011, and had been spending roughly $700,000 per month during the third quarter of last year.

Powertech has not issued its year-end financial statements. But assuming the same cash burn rate and no new financing, the company will be out of cash by late spring or early summer.

JW

Powertech requests more time to file opening brief in lawsuit

Posted February 19, 2011

According to someone familiar with the situation, Powertech attorney John Fognani wants to extend the deadline for filing the Canadian company's opening brief in its lawsuit against the Colorado Mined Land Reclamation Board (MLRB).

Under Colorado law, the original filing deadline is March 7. Fognani has discussed a two week extension with the Colorado Attorney General's office, and it is likely the extension will not be opposed and will be granted by the court.

Powertech sued the state in late 2010 following a lengthy rulemaking process conducted by the Division of Reclamation, Mining and Safety and the MLRB. The purpose of the rulemaking was to establish regulations to implement new legislation regarding in-situ leach uranium mining.

The primary bill, House Bill 08-1161, was adopted in 2008 in response to Powertech's proposed Centennial uranium project in Weld County. The bill established new requirements for permitting, operating, and reclaiming in-situ leach uranium mines.

HB 08-1161 had strong grassroots support and passed both the Colorado House and Senate by wide margins.

Powertech's lawsuit seeks to overturn certain regulations implementing key provisions of HB 08-1161 and related bills. In an August 2010 written response to the MLRB, Fognani and Powertech CEO Dick Clement stated that a particular requirement related to baseline water quality information "would be fatal to any serious potential in situ recovery project."

The lawsuit appears to be Powertech's final attempt to salvage the troubled Centennial project. In the last year, Powertech has relinquished control of a large land and mineral position, suspended all permitting activities with the U.S. Environmental Protection Agency and the Colorado Division of Reclamation, Mining & Safety, and closed its project office in Wellington, Colorado. It is unclear if the two employees assigned to the project, Terry Walsh and Mike Beshore, are still with the company.

JW

GAME ON!

Powertech files certified record in lawsuit against State of Colorado; company's opening brief is due March 7

Posted February 1, 2012, Updated February 12, 2012

Powertech has filed its Notice of Filing of Certified Record with the Denver District Court, setting into motion the briefing phase of its lawsuit against the Colorado Mined Land Reclamation Board (MLRB).

The notice, along with an index and compact disc containing 5,997 pages of documents, was filed on January 27, the deadline set earlier by District Court Judge William W. Hood III.

The record covers virtually the entire rulemaking process conducted by the MLRB to establish regulations following the 2008 passage of Colorado House Bill 08-1161 and other related bills. HB 08-1161 requires mining companies to restore groundwater to at least baseline conditions or state water quality standards following in-situ leach uranium mining, among other provisions.

By agreement between Powertech and the MLRB, certain emails, letters, and statements submitted by members of the public were omitted from the certified record. According to someone familiar with the matter, these comments by members of the public were never forwarded to the MLRB by the Colorado Division of Reclamation, Mining and Safety.

In accordance with Colorado statutes, the filing triggers a forty day period during which Powertech's attorneys must file an opening brief arguing the merits of the Canadian company's case. Powertech's complaint alleges that many of the rules are "unreasonable, arbitrary, capricious or otherwise contrary to law."

The deadline for Powertech's opening brief is March 7. Powertech filed the lawsuit on November 1, 2010.

JW

Exhibit B - MLRB Record Index - January 27, 2012 (PDF 59 KB, 2 pages)

Judge Hood to Powertech: File case record by January 27 or lawsuit will be dismissed

Powertech's lawsuit against state of Colorado hits another bump in the road

Posted January 9, 2012

Judge William W. Hood III has responded to Powertech's foot-dragging on its lawsuit against the state of Colorado by giving the Canadian start-up company until January 27 to file the certified record of the case, which includes transcripts of the rulemaking proceedings.

|

| Denver District Court Judge William W. Hood III |

The lawsuit seeks to overturn new Colorado uranium mining rules that were described by Powertech CEO Dick Clement as "fatal" to the proposed Centennial project. Clement later flip-flopped, saying the rules are "livable".

Among other provisions, the new rules require that uranium mining companies restore groundwater to baseline conditions or to state water quality standards following in-situ leach mining.

But Powertech's lawsuit has been plagued with problems and setbacks from the start.

|

| Powertech attorney John Fognani |

After filing the action, the law firm failed to serve the Colorado Attorney General as required under the Colorado Rules of Civil Procedure. Fognani & Faught also failed to comply with the Colorado Administrative Procedure Act by sending a notice of the lawsuit and a copy of the complaint to participants in the rulemaking process.

Three weeks after the lawsuit was filed, Colorado Attorney General John Suthers noted in a filing with the court that "to date, the Colorado Attorney General's Office has not been served with a copy of the Summons and Complaint, as required" and that "Plaintiff (Powertech) has failed to notify the many hundreds of people who participated in this rulemaking proceeding of the filing of this judicial review litigation as required."

Presumably, Powertech and its law firm served the AG and notified the rulemaking participants following Suthers' filing.

On December 8, 2010, Suthers filed a motion to dismiss Powertech's claims against Mike King, the Executive Director of the Colorado Department of Natural Resources. King served on the MLRB during the rulemaking and acted as hearing officer.

Under Colorado law, Powertech can seek judicial review of "final agency action", but Suthers argued that King, unlike the MLRB, had no authority to take final agency action. Judge Hood granted Suthers' motion and dismissed King from the lawsuit on March 31, 2011.

On January 25, 2011, Suthers and Assistant Attorney General Jeff Fugate filed the MLRB's answer to Powertech's complaint, signaling the state's intention to fight the lawsuit.

An April 26 order by Judge Hood agreed with arguments by the attorney general and subsequently dismissed two of the four claims made by Powertech against the MLRB. In one of the claims, Powertech asserted that certain Colorado legislators violated the "separation of powers" clause of the Colorado Constitution by sending letters to the MLRB regarding the rulemaking.

Judge Hood dismissed that claim since Powertech did not name the legislators as defendants, and Powertech did not state a separation of powers claim against the MLRB.

On June 28, 2011, Judge Hood granted an order approving the intervention of three citizens groups in support of the MLRB. The groups, Coloradoans Against Resource Destruction (CARD), Tallahassee Area Community, Inc., and Sheep Mountain Alliance, were all active in the rulemaking proceedings. The intervention brought noteworthy attorneys Jeffrey Parsons and Travis Stills into the fight against Powertech's lawsuit.

From the beginning, Powertech has hoped that it would attract help for its lawsuit from other uranium companies. In a November 18, 2010 news story in the Fort Collins Coloradoan, Clement said that Powertech was going to bat for the entire uranium industry with its lawsuit. "This is a lawsuit on behalf of industry, not just Powertech", asserted Clement in the article.

Apparently, the industry hasn't gotten the message. According to people familiar with the matter, Powertech officials blame their year-long delay in advancing the lawsuit on their inablility to convince other mining companies to help foot the bill for the litigation.